However, this triple-digit price uptick has been accompanied by a growing short interest, suggesting that many traders remain skeptical about its long-term prospects.

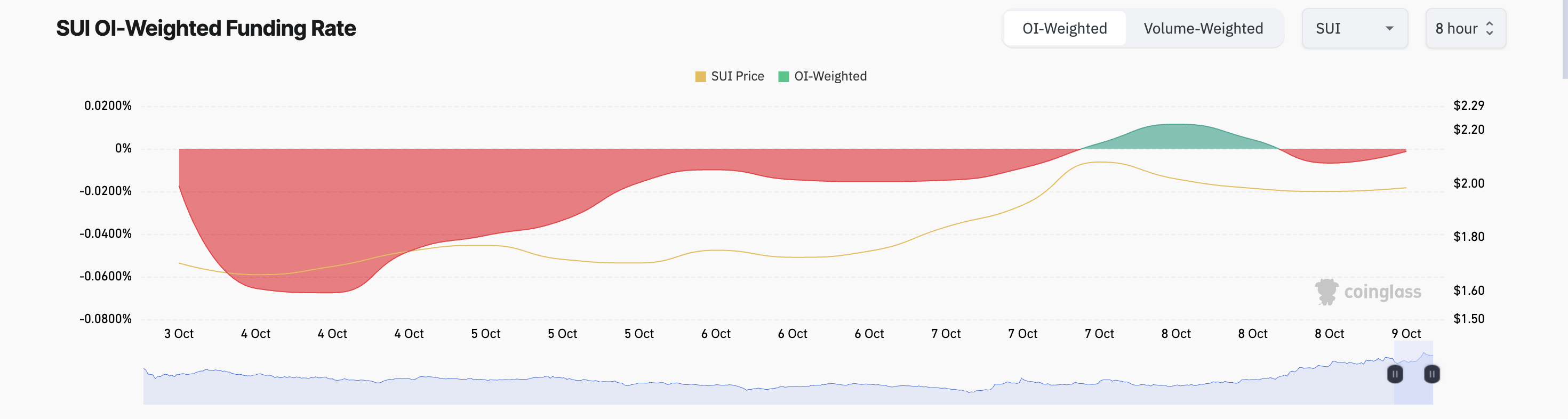

SUI has witnessed a spike in demand for short positions since the beginning of October, as evidenced by its negative funding rate sitting at -0.0012% as of this writing.

Funding rates are periodic fees to ensure an asset's contract price stays close to its spot price. A negative rate indicates that traders are paying to keep short positions open, signaling a bearish outlook. When funding rates are negative during a price rally, short sellers are dominant and willing to pay to maintain their short positions despite the rising price.

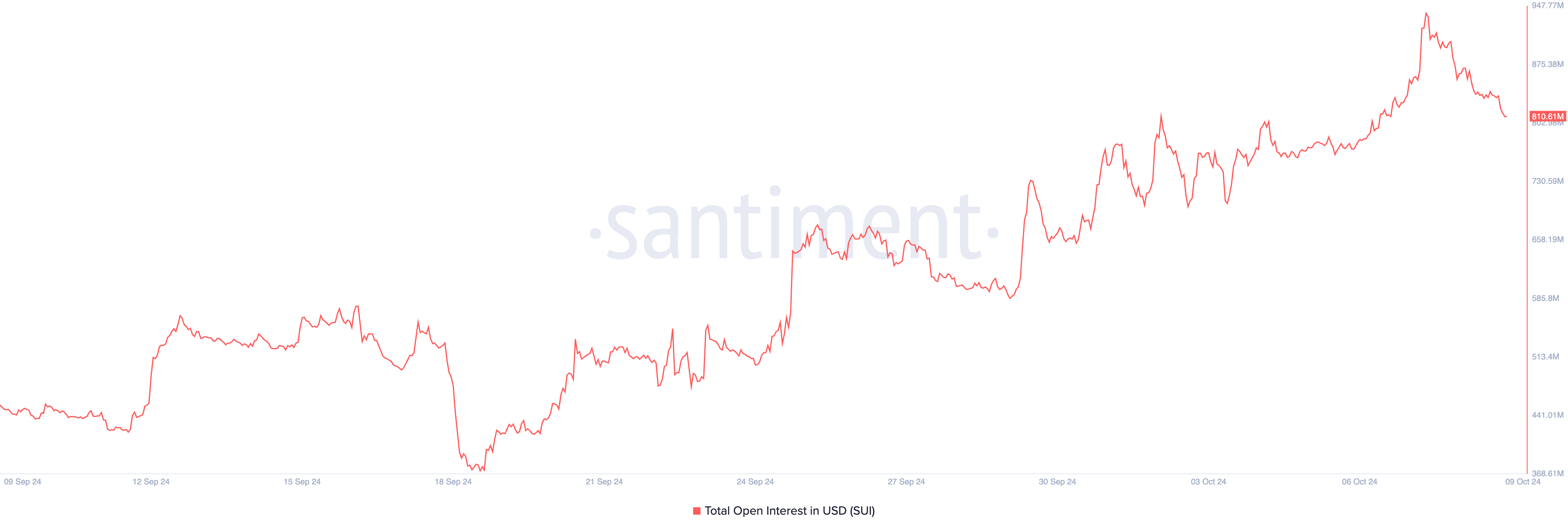

This bearish outlook is further compounded by SUI's rising open interest, which currently stands at $810 million — the highest level since December 2023.

Rising open interest generally indicates that new positions are being opened, signaling growing interest or participation in the market. However, when negative funding rates accompany this, a significant number of the new positions being opened are short. It suggests that market sentiment remains bearish, as more participants are willing to bet against the price increase.

Despite the strong demand for short positions, SUI's price has continued to climb. If its funding rate stays negative while the value rises, a short squeeze could occur.

In such a scenario, short sellers may be forced to close their positions by buying back the asset, which could further drive up the price. Should this happen, SUI could potentially reclaim its all-time high of $2.18, a level it last reached on March 27.

However, if the demand for SUI drops and it witnesses a correction, its price may decline toward $1.81. If selling pressure gains momentum, this drawdown could extend to $1.52.

.aff-primary {

display: none;

}

.aff-secondary {

display: block;

}

.aff-ternary {

display: none;

}

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.