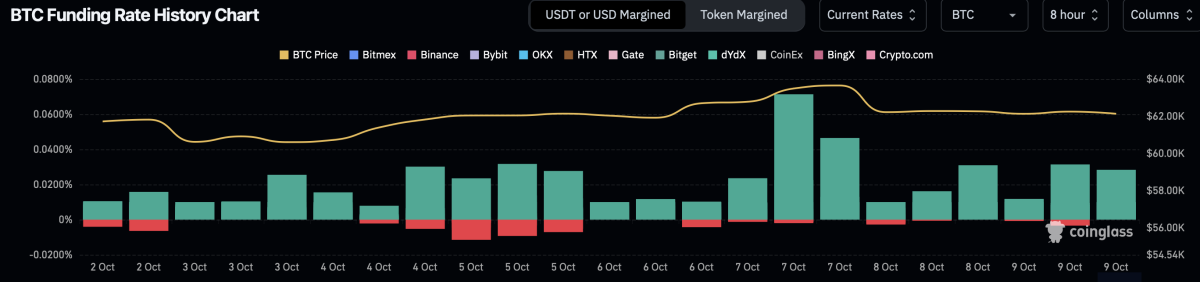

QCP Capital analysts have cautioned that the recent rise in perpetual futures funding rates indicates the cryptocurrency market may be vulnerable to unexpected downside moves, as traders leverage positions in a speculative bullish trend.

“The perpetual futures funding rate across Deribit and Binance has increased in the past two weeks, a sign that bearish bets are decreasing or longs are building. This, combined with the froth in memecoins, makes us wary of moves to the downside, as these often happen when markets are bullish and least expect it,” QCP Capital analysts said.

Bitcoin futures funding rate has remained mostly positive since the beginning of October. Image: Coinglass.

The analysts noted a potential shift in market dynamics with increased memecoin activity, viewing it as a signal of heightened speculation. “There is some froth in the memecoin market as traders capitalize on the latest trends,” they added.

Despite the potential for a brief sell-off in an over-leveraged market, the analysts maintain a bullish medium- to long-term outlook. They recommend accumulation strategies that allow investors to gradually increase their holdings over time, even amid short-term uncertainties. “We look to continue accumulating despite short-term dips, as we believe risk-off selloffs will be short-lived,” they explained.

See Crypto Indices

U.S. inflation reports could heighten market volatility

As traders navigate these volatile conditions, BRN analyst Valentin Fournier noted that investors are currently hesitant and looking for clearer guidance. He highlighted that the upcoming U.S. Consumer Price Index (CPI) report on Thursday, followed by the Producer Price Index (PPI) on Friday, is expected to inject volatility into the market. “Should inflation show signs of decreasing as anticipated, bitcoin could see another upward push,” Fournier said in an email sent to The Block.

On Thursday, September's CPI report is expected to indicate that inflation continues to soften, largely due to falling energy prices. Economists anticipate that consumer prices rose by 0.1% on a monthly basis in September, following a 0.2% rise in August, according to FactSet's consensus estimates. This would bring the overall inflation rate down to 2.3% from 2.5% in August, strengthening the U.S. Federal Reserve's recent pivot to a rate-cutting cycle.

Bitcoin's price fell by around 1% in the past 24 hours and was sitting at around $62,072 at 8:10 a.m. ET, according to The Block's Bitcoin Price Page. As of today, the global cryptocurrency market cap stands at $2.27 trillion, reflecting a decrease of 1.5% in the past 24 hours. Total cryptocurrency trading volume in the past day is $82.7 billion, with Bitcoin dominance at 54.2% and Ethereum dominance at 12.9%, according to Coingecko data.