Previously, there were looming doubts about Ethereum potentially being classified as an unregistered security. This uncertainty had been a significant concern for investors, affecting the asset's market performance. However, the investigation's closure has now reinstated investor confidence, propelling a modest rise in Ethereum's market value.

Ethereum Marked Safe From the SEC

The SEC's probe focused on the Ethereum Foundation and raised questions about whether Ethereum should be regulated as a security. This classification could have severely impacted demand for the digital asset.

In response, Consensys, a key entity within the Ethereum ecosystem, initiated a lawsuit on April 25, 2024. The lawsuit challenged the SEC's jurisdiction, arguing that Ethereum qualifies as a commodity and thus should not fall under stringent SEC regulations.

Consensys' legal challenge was a strategic move against perceived regulatory overreach. The suit requested judicial confirmation that Ethereum is not a security.

Support for Consensys' position grew, marked by significant public and political advocacy. This culminated in a formal plea on June 7, urging the SEC to reconsider its stance.

Subsequently, on June 18, the SEC's Enforcement Division responded positively.

“Today, the Enforcement Division of the SEC responded by notifying us that it is closing its investigation into Ethereum 2.0 and will not pursue an enforcement action against Consensys,” the company announced.

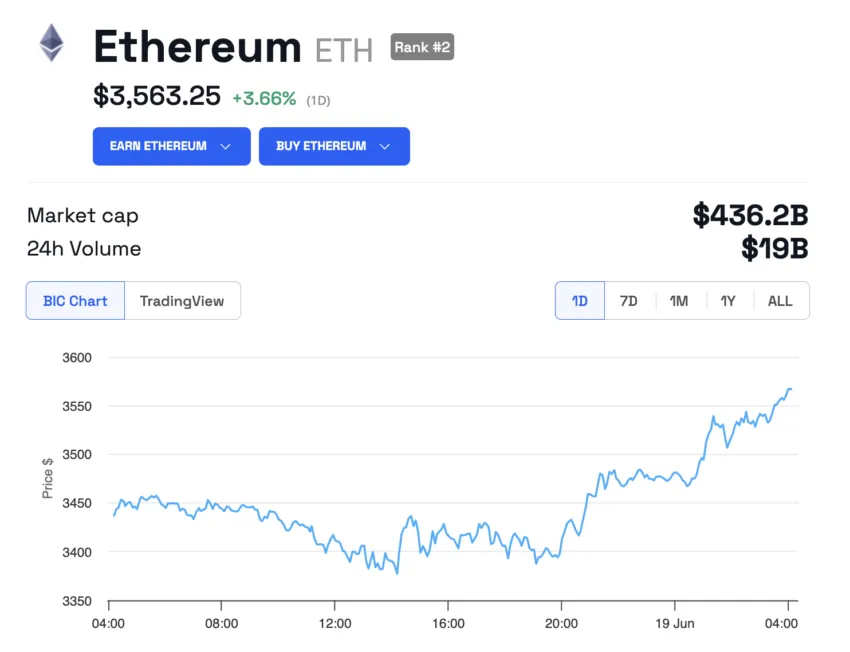

Following this announcement, Ethereum experienced a price increase, trading at $3,563. This response highlights the market's sensitivity to regulatory news, particularly concerning leading cryptocurrencies like Ethereum.

Despite this victory, Consensys is pushing for more definitive regulations that foster rather than hinder innovation. The company advocates for regulatory clarity that accommodates the unique aspects of crypto and decentralized platforms. This approach is essential, as it seeks to protect investor interests and promote technological advancement without undue restrictions.

“The SEC is a securities regulator, not a software regulator. Gary Gensler and the SEC should stay in their lane as they have important work that they need to do with actual securities. They've been distracted by this really unlawful excursion into the crypto space,” a Consensys spokesperson told BeInCrypto.

The broader debate concerning the classification of digital assets continues to be a contentious issue within regulatory circles. While Bitcoin is generally accepted as a commodity, the SEC maintains that most other cryptocurrencies should be treated as unregistered securities under its oversight.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.