Mixed signals from various technical indicators are adding to the ambiguity, making it difficult to predict whether Ethereum can climb back to $3,000 soon.

Ethereum Is Losing Money

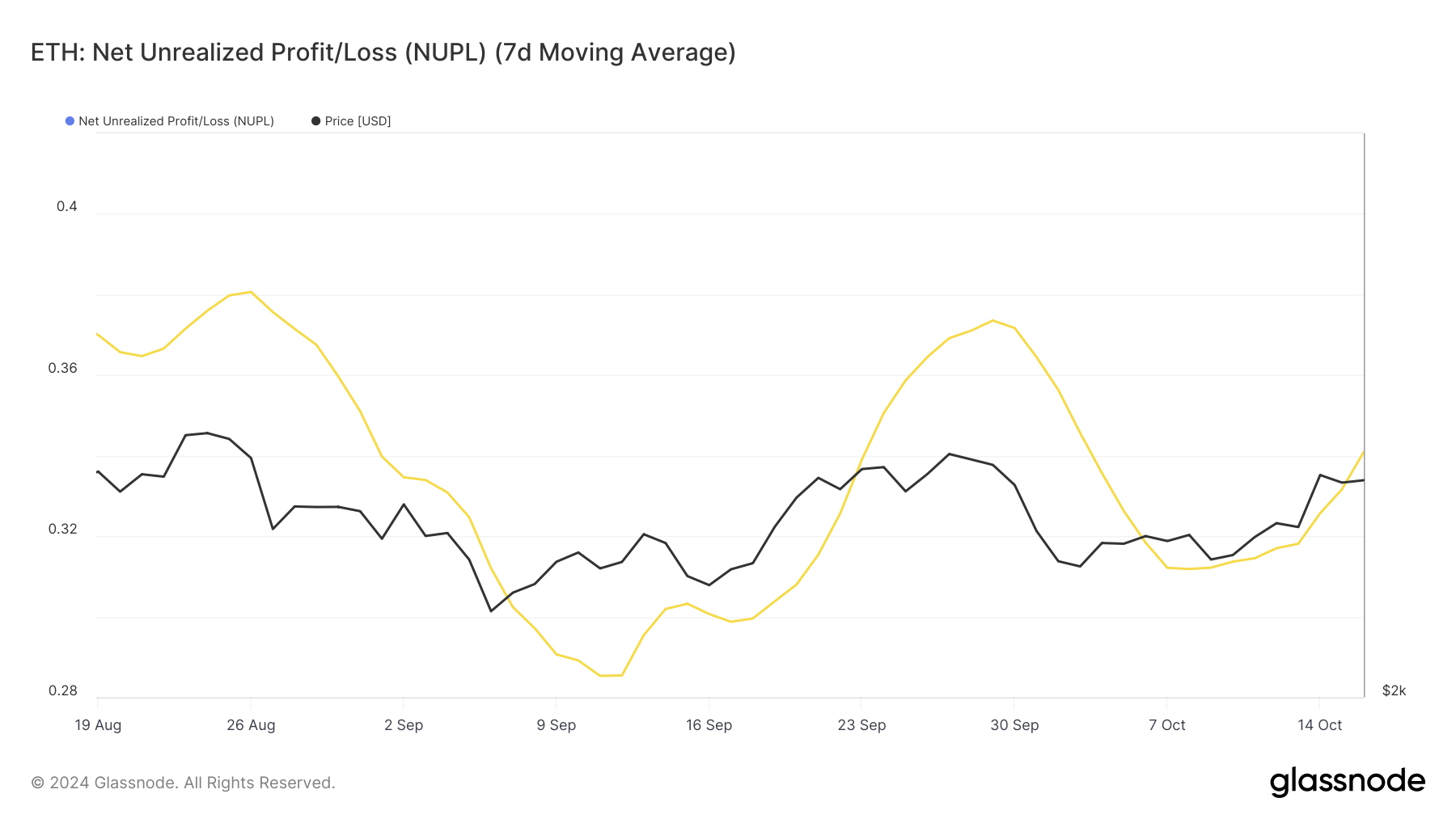

Ethereum's Network Unrealized Profit/Loss (NUPL) currently sits in the optimism zone, signaling improving market sentiment. This indicator tracks all holders' total profit or loss relative to when they acquired their assets. The current levels reflect growing confidence among investors.

This optimistic sentiment is keeping investors engaged, with many holding their assets rather than selling them. As long as the NUPL remains in this favorable range, the chances of a dramatic sell-off are slim, which could support Ethereum's price in the near term.

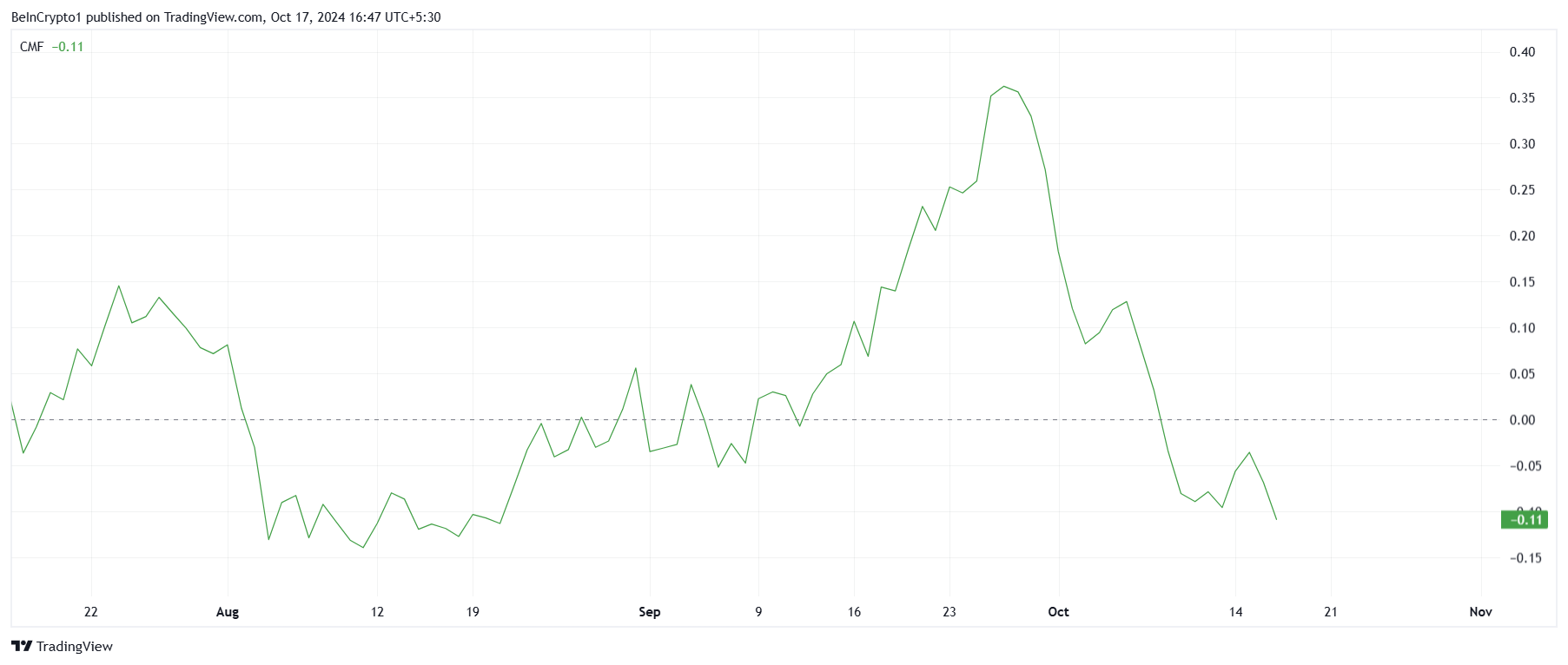

On the macro side, Ethereum's momentum appears mixed, as shown by the Chaikin Money Flow (CMF) indicator. The CMF, which tracks the flow of capital into and out of an asset, briefly rose last week but has since dipped again.

This decline is a bearish signal, as it suggests that more capital is flowing out of Ethereum than coming in. It is an indication that the selling pressure is potentially increasing.

The outflow of capital is a critical factor to watch, as sustained declines in the CMF often precede price drops. Ethereum could face additional challenges in breaking through its current resistance levels despite the otherwise positive market sentiment if this trend continues.

ETH Price Prediction: Staying in Lane

Ethereum is currently trading at $2,610, struggling to overcome resistance at $2,700. Since early August, ETH has been repeatedly blocked by this level, with brief breaches above it failing to hold. As long as Ethereum remains under this resistance, significant upward momentum may be difficult to achieve.

Mixed signals from key indicators suggest that the ongoing consolidation between $2,700 and $2,344 will continue. The market may remain in this tight range until there is a decisive shift in sentiment or capital inflows.

For Ethereum to reach $3,000, it must first flip the $2,700 resistance into support. Once this level is breached, the next key barrier will be $2,930. If Ethereum can rise above this, it will hit a two-and-a-half-month high, potentially invalidating the current bearish outlook.

.aff-primary {

display: none;

}

.aff-secondary {

display: block;

}

.aff-ternary {

display: none;

}

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.