“Stablecoins have reached a whole new level of product-market fit,” a16z Chief Technology Officer Eddy Lazzarin told CoinDesk in an interview. “Stablecoin issuance, stablecoin transfers and use are off the charts on all levels.”

In its 2024 report, a16z cautioned that crypto's longstanding lack of regulatory clarity – in the U.S. and abroad – has paved the way for the proliferation of speculative memecoins.

While meme-driven, celebrity-endorsed digital assets have helped bring some retail enthusiasm back to crypto over the past year, there is nagging concern that the assets could pose a reputational risk to the industry – particularly given their propensity for scams, rug pulls and other abuses.

“The irony is that it's actually a little more obvious how one ought to release a legal, fair memecoin than it is to launch a legal network token,” said Lazzarin, “which is the term I like to use for a token that represents a decentralized network and is integral to it.”

A16z co-founders Marc Andreessen and Ben Horowitz recently announced that they were supporting Donald Trump in the 2024 election, citing Trump's promise to “end the unlawful and un-American crypto crackdown” as a decisive factor in their endorsement.

However, following Joe Biden's withdrawal from the race, Horowitz made personal donations to Kamala Harris's campaign, acknowledging the complexity of the political climate and the difficulty of choosing sides.

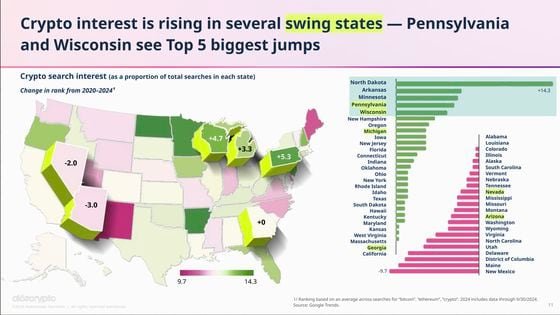

U.S. regulatory uncertainty has been a central theme in a16z's past reports, but this year's edition underscores crypto's growing presence in political discussions, particularly as it gains traction in swing states like Pennsylvania and Wisconsin. The report points to promising “bipartisan” progress in advancing regulatory clarity in the U.S.

A16z's report notes that key technical breakthroughs in blockchain technology have brought the cost of sending transactions – particularly stablecoins like tether (USDT) and USD coin (USDC) – to all-time lows.

Ethereum's EIP-4844 upgrade, for example, fueled the development of cheaper “layer-2” blockchains like Coinbase's Base network, Lazzarin emphasized.

“It costs less than a penny to send USDC on base, and that has been a sustainable pattern despite increasing use,” he told CoinDesk.

Additionally, “more modern blockchains” like Sui and Solana “have led to a 99% drop in the cost to send U.S. dollars in the form of a stablecoin internationally,” said Lazzarin.

As with previous years, a16z has published a companion “Crypto Index” data visualizer for its 2024 report.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/EQLJ6TNWIZB2JPU7A5YSZYDTGY.png) A16z's “State of Crypto Index” has reached new all-time highs (a16z)

A16z's “State of Crypto Index” has reached new all-time highs (a16z)Although certain key metrics like “active developers” and “interested developers” have apparently fallen over the past year, a16z's composite “state of crypto index” score – which weighs crypto progress measures according to their purported importance – ranks near an all-time high.