.

As the meme coin trends toward being overbought, a correction could be on the horizon. This analysis outlines potential price targets token holders need to look out for.

NEIRO's price, as assessed on a 12-hour chart, is poised to cross above the upper bands of its Bollinger Bands indicator. When an asset's price trends toward the upper band of the Bollinger Bands, it indicates that the asset is experiencing increased volatility and may be approaching overbought territory.

While trending toward the upper band is often a sign of market strength, it also indicates that the asset may soon witness a correction, especially if other indicators confirm overbought conditions.

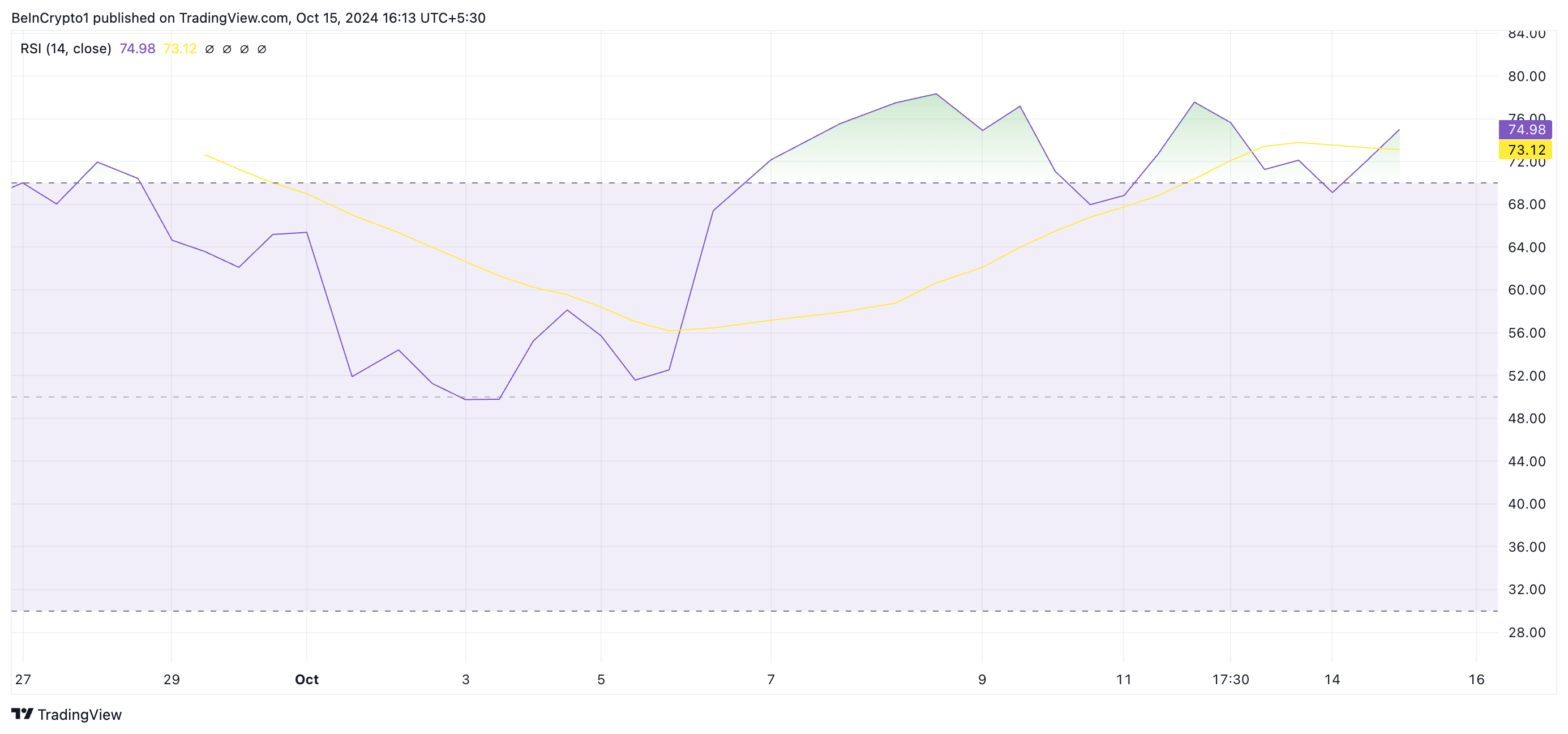

Moreover, NEIRO's surging Relative Strength Index (RSI) confirms this. This indicator measures an asset's overbought and oversold market conditions.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. In contrast, values below 30 indicate that the asset is oversold and may witness a rebound.

At press time, NEIRO's RSI is sitting at 74.93, indicating that the meme coin may shed some of its gains soon.

Increasing selling pressure will likely cause NEIRO's price to pull back. Based on Fibonacci Retracement levels, the price may decline by 18%, potentially settling at $0.0018.

If the bulls fail to defend this support line, the meme coin's value could plummet by an additional 51%, dropping to $0.00091.

Conversely, if buyers resume activity, NEIRO could reclaim its all-time high of $0.0023. It may then attempt to break through this resistance level.

.aff-primary {

display: none;

}

.aff-secondary {

display: block;

}

.aff-ternary {

display: none;

}

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.